What is a structured settlement?

A structured settlement is an agreement utilized in the resolution of a dispute where the plaintiff receives future payments in lieu of a lump sum. It can be used for the full amount or a partial amount of the plaintiff’s recovery. The payments can be made in regular installments, such as monthly or annual payments, or in lump sums. The payments can begin immediately or be deferred to a later date. The party taking on the obligation to make the future payments typically purchases an annuity from an insurance company to guarantee the payments are made in full. This arrangement provides security to the plaintiff and removes their funds from the ups and downs of the market.

What are the benefits of a structured settlement?

- Tax-free growth for qualified settlements

- Flexible formatting allows customized plan tailored to individual needs

- Ability to preserve government benefits such as SSI, Medicare and Medicaid

- Stress-free investment because payments are guaranteed

- Security of lifetime payments prevents complete depletion of assets

- Ability to designate a beneficiary to receive remaining guaranteed payments

- No investment fees or ongoing management costs

- Option to have an annual cost of living adjustment

- Protection from risk of excessive spending, bad investments, and volatile market conditions

- Protection of future annuity payments from claims of creditors in most states

- Medical underwriting could increase payment amounts of lifetime payments

Process

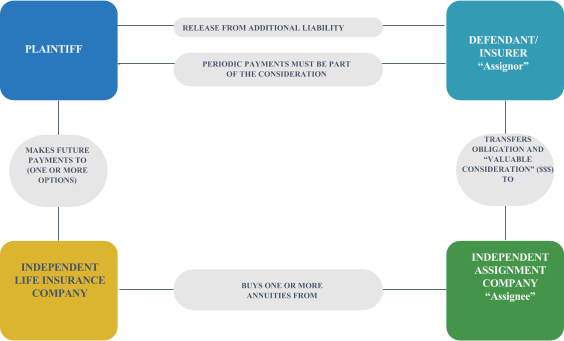

As part of settlement negotiations in personal injury cases, either the plaintiff or the defendant may propose a structured settlement involving the payment of agreed sums over specified time periods. Both parties must ultimately agree to all terms and conditions to consummate a structured settlement. Independent Assignment Company would accept the obligation of future payments in exchange for valuable consideration. Independent Assignment Company would purchase a custom annuity from Independent Life Insurance Company to satisfy the obligation. Independent Life Insurance Company would make the payments directly to the plaintiff as directed by Independent Assignment Company. The companies are using the Qualified Assignment methodology pursuant to IRC section 130 outlined below:

Attorney Fee Structures

Structuring future payments from a settlement is not just limited to the plaintiff; the attorney can also exercise this option to provide tax-efficient growth of the funds. The power of tax deferral allows the attorney to reduce their current tax burden and shift it to future years where income levels may be lower or non-existent.

For example, a 50-year old attorney earning a fee of $500,000 now (thus exposing themselves to the highest tax bracket), can instead defer the $500,000 to age 65 for a monthly payout of $4,500 for life, guaranteed for 15 years. By doing this, the attorney pays no tax in the current year or any subsequent year until the payments begin at age 65. Thereafter, the attorney would have $54,000 annually of taxable income. Depending on other income sources, the attorney will save tens of thousands of dollars in taxes, while also growing the initial premium invested.

Other notables about attorney fee structures:

- The plaintiff is not required to do a structure themselves

- The underlying claim must be for either workers’ compensation or for damages on account of personal physical injury or physical sickness

- Attorney has the option to make the annuity payee the law firm

- Attorney can create a joint-life annuity with their spouse so that the payments never end as long one spouse is alive

- The landmark case that allows attorneys to defer their tax obligation on fees is Childs v. Commissioner, 103 T.C. 634 (1994)

Medicare Set-Asides

When a Medicare recipient has been injured and receives funds to resolve their claim, Medicare requires that funds be set-aside to pay for future medical expenses associated with the injuries sustained in the accident. It is Medicare’s position that Medicare should be a secondary payer for these expenses. If funds are not set-aside, the plaintiff risks losing their Medicare eligibility.

To determine what needs to be set-aside, an allocation report is created by a professional well versed in Medicare compliance. The result of the allocation report informs the plaintiff and their representatives what the total amount to be set-aside is, taking into account the plaintiff’s life expectancy.

The plaintiff can either set-aside the full amount in an interest-bearing checking account, or they can utilize a structured settlement to make an annual payment into the Medicare Set-Aside account. By using a structured settlement, a significant cost-savings can be realized as the interest rate of the annuity allows for less money to be used from the outset to achieve the same result.

Example:

John Doe

Age: 41

Remaining Natural Life Expectancy: 40 years

Reduced Life Expectancy Based Upon Injuries: 32 years

Total Medicare Set-Aside: $203,666

Total Seed Money: $12,729.12

Annual Payment for 31 years: $6.159.25Option #1: Deposit $203,666 into an interest-bearing checking account and spend

it down until nothing remains.Option #2: Use a structured settlement to reduce the cost from $203,666 to:

- $121,763 = 31 Year Temporary Life annuity plan

- $134,663 = 31 Year Guaranteed annuity plan

- $146,406 = Life with 20 Years Guaranteed annuity plan