FAQ

What is a structured settlement?

A structured settlement is a financial agreement utilized in the resolution of a dispute where the plaintiff receives fixed and determinable future payments in lieu of a lump sum now. It can be used for the full amount or a partial amount of the plaintiff’s recovery. The payments can be made in regular installments, such as monthly or annual payments, or in lump sums, or in any pattern that meets the needs of the plaintiff. The payments can begin immediately or be deferred to a later date. The defendant transfers the responsibility for making the future payments to a qualified assignment company, an entity specially designed to take on this responsibility. The assignment company typically purchases an annuity from an affiliated insurance company and the insurance company has the financial strength to assure all payments are made when due. This arrangement provides security to the plaintiff, eliminating the investment risk inherent with the plaintiff trying to manage the alternative lump sum.

What are the benefits of a structured settlement?

- All future payments are Income Tax free

- Payments customized to meet individual needs

- Well-suited for strategies to preserve government benefits such as SSI, Medicare and Medicaid

- Relief from the stress of investment management with protection from bad investments and volatile market conditions

- Payments can be chosen “for life”, eliminating the financial concerns of living longer than average

- For payees with a reduced life expectancy, medical underwriting could increase payment amounts of lifetime payments

- Ability to designate a beneficiary to receive remaining guaranteed payments

- No investment fees or ongoing management costs

- Option to receive annually increasing payments

- Less temptation to over spend than with a lump sum

- Future annuity payments exempt from claims of creditors in most states, unlike a lump sum

How does the process work?

How does the process work?

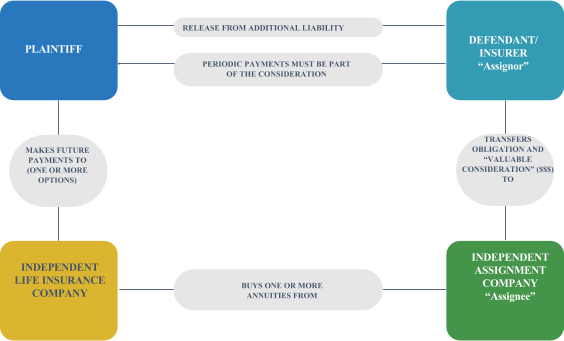

As part of settlement negotiations in personal injury cases, either the plaintiff or the defendant may propose a structured settlement involving the payment of agreed sums over specified time periods. Both parties must ultimately agree to all terms and conditions to consummate a structured settlement. Independent Assignment Company would accept the obligation of future payments in exchange for valuable consideration. Independent Assignment Company would purchase a custom annuity from Independent Life Insurance Company to satisfy the obligation. Independent Life Insurance Company would make the payments directly to the plaintiff as directed by Independent Assignment Company. The companies are using the Qualified Assignment methodology pursuant to IRC section 130 outlined below:

What are the attorney fee structures?

Structuring future payments from a settlement is not just limited to the plaintiff; the attorney can also exercise this option to spread the receipt of fees over many years. The power of tax deferral allows the attorney to reduce their current tax burden and shift it to future years when tax rates may be lower.

For example, a 50-year old attorney earning a fee of $500,000 now (thus exposing themselves to the highest tax bracket), can instead defer the $500,000 to age 65 for a monthly payout of $4,500 for life, guaranteed for 15 years. By doing this, the attorney pays no tax in the current year or any subsequent year until the payments begin at age 65. Thereafter, the attorney would have $54,000 annually of taxable income. Depending on other income sources, the attorney will save tens of thousands of dollars in taxes, while also growing the initial premium invested.

Other notables about attorney fee structures:

- The plaintiff is not required to do a structure themselves

- The underlying claim must be for either workers’ compensation or for damages on account of personal physical injury or physical sickness

- Attorney has the option to make the annuity payee the law firm

- Attorney can create a joint-life annuity with their spouse so that the payments never end as long one spouse is alive

- The landmark case that allows attorneys to defer their tax obligation on fees is Childs v. Commissioner, 103 T.C. 634 (1994)

What are Medicare Set-Asides?

When a Medicare recipient has been injured and receives funds to resolve their claim, Medicare requires that funds be set-aside to pay for future medical expenses associated with the injuries sustained in the accident. It is Medicare’s position that Medicare should be a secondary payer for these expenses. If funds are not set-aside, the plaintiff risks losing their Medicare eligibility. To determine what needs to be set-aside, an allocation report is created by a professional well versed in Medicare compliance. The result of the allocation report informs the plaintiff and their representatives what the total amount to be set-aside is, taking into account the plaintiff’s life expectancy. The plaintiff can either set-aside the full amount in an interest-bearing checking account, or they can utilize a structured settlement to make an annual payment into the Medicare Set-Aside account. By using a structured settlement, a significant cost-savings can be realized as the interest rate of the annuity allows for less money to be used from the outset to achieve the same result.

Example:

John Doe

Age: 41

Remaining Life Expectancy for an uninjured, similar person: 40 years

Reduced Life Expectancy Based Upon Injuries: 32 years

Total Medicare Set-Aside: $203,666

Total Seed Money: $12,729.12

Annual Payment for 31 years: $6,159.25

Option #1: Deposit $203,666 into an interest-bearing checking account and spend it down until nothing remains. If the injured person dies and there is money left over it can be distributed via the injured person’s estate.

Option #2: Use a structured settlement to reduce the cost from $203,666 to:

- $121,763 = 31 Year Temporary Life annuity plan

- $134,663 = 31 Year Guaranteed annuity plan

- $146,406 = Life with 20 Years Guaranteed annuity plan

Remaining guaranteed payments after the injured person’s death would go to a named beneficiary.

How does the rated age process work?

When Independent Life receives a request for a rated age, our underwriter reviews the file and provides a rated age.

Should the case be deemed a candidate for a more in-depth evaluation, Independent Life may, at substantial expense, have Fasano Associates, a leading underwriting firm in the life, annuity, and life settlement markets, evaluate the risk with their multi-physician process led by Medical Director Dr. David Vaughan, producing a comprehensive evaluation of the injury victim’s life expectancy.

If Independent Life thinks using this more comprehensive process would be productive AND the broker concurs then Independent Life may choose to access this process. Before Independent Life does so however the plaintiff’s attorney must verify the following and send a letter to Independent Life so stating that:

- The plaintiff’s attorney has concluded Independent is a suitable option for the plaintiff,

- The plaintiff’s attorney will present Independent as a suitable option to the plaintiff,

- The party issuing the settlement check has approved the use of Independent for a structured settlement.

- The parties can wait to make a decision until the process is complete (expect it to take two weeks)

Fasano Associates has tuned their methods to the realities of each market they serve and have recently reported Actual to Expected ratios of 98% for structured settlements, far superior to other third-party underwriters. This extensive process could take up to two weeks, so it may not be a suitable option for each case.

How do I get a quote?

Independent will bring the structured settlement quoting process into the modern era with our innovative platform of technology. We will provide structured settlement professionals with a desktop quoting application, Independent Quote Systems (IQS), that feels simple and efficient to use. IQS is currently in a Beta version and our technology team will push out regular updates to improve performance. We want to create as many ways and channels as possible for Independent to be quoted:

- "Snap-A-Quote" – Brokers can send us a "Snap" of a quote via SnapChat and we will "Snap" you back through the app

- "Text-A-Quote" – Text one of our representatives a picture of a quote and we will text you back with an Independent quote

- Web-based Quoting – Quote through our website with any browser, from any computer (Coming later this year)

- Mobile App – Quote on your phone and email to your client (Coming later this year)

Our goal is simple: provide brokers and settlement participants with the quotes they need, where and when they need them, in the way they want to receive them.

Independent recognizes that cases are won and lost in the trenches and that daily rates help resolve claims faster and lead to more "wins". Independent strives to have pricing requests approved in less than one hour from the submission time. We will also offer extended response times so that our West Coast professionals do not have to wait until the next business day when they need help immediately. If needed, our team is prepared to offer quotes on the weekends to help get the structured settlement placed. If you have a case you would like to discuss or have a question, please do not hesitate to call 1-800-793-0848 or email us at quotes@Independent.life.